What are Market Correlations in Forex Trading?

Market correlations in forex trading refer to the degree to which the prices of different currency pairs move in relation to each other. Positive correlations indicate that the prices of two currency pairs tend to move in the same direction, while negative correlations indicate that they tend to move in opposite directions. Understanding market correlations can help traders identify potential opportunities and manage risk by diversifying their portfolios and avoiding overexposure to certain currency pairs. However, it is important to note that market correlations can change over time and can be affected by a wide range of economic, political, and other factors. In addition, there are non-currency market correlations in play throughout the FX market. We will also touch on these.

How to Identify and Measure Market Correlations

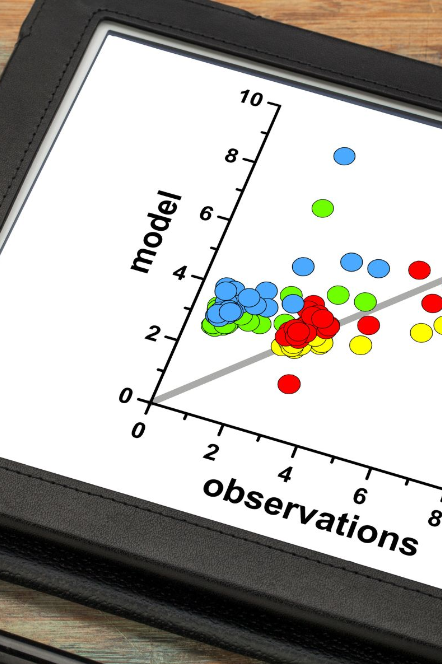

To identify and measure market correlations, traders can use statistical tools such as correlation coefficients and scatter plots to analyze the relationship between different currency pairs. They can also use historical price data and charting software to visualize trends and patterns in the market. By regularly monitoring and analyzing market correlations, traders can gain insights into potential trading opportunities and manage risk by diversifying their portfolios.

Positive Correlations and Negative Correlations

Positive correlations refer to the relationship between two variables in which they move in the same direction. In the context of forex trading, a positive correlation between two currency pairs means that their prices tend to move in the same direction. For example, if the EUR/USD and GBP/USD pairs have a positive correlation, a rise in the price of EUR/USD may also lead to a rise in the price of GBP/USD.

Negative correlations, on the other hand, refer to the relationship between two variables in which they move in opposite directions. In forex trading, a negative correlation between two currency pairs means that their prices tend to move in opposite directions. For example, if the USD/JPY and USD/CHF pairs have a negative correlation, a rise in the price of USD/JPY may lead to a fall in the price of USD/CHF.

Understanding the Correlation Coefficient

The correlation coefficient is a statistical measure that quantifies the strength and direction of the relationship between two variables. It ranges from -1 to 1, with -1 indicating a perfect negative correlation (when one variable increases, the other decreases), 0 indicating no correlation, and 1 indicating a perfect positive correlation (when one variable increases, the other also increases). In forex trading, the correlation coefficient is often used to measure the degree of correlation between different currency pairs, which can help traders understand how they may move in relation to one another.

Types of Market Correlations in Forex Trading

Currency Pairs and Commodity Prices

The correlation between currency pairs and commodity prices can be complex and multifaceted. In general, commodity prices tend to have a strong impact on the currencies of countries that are major producers or consumers of those commodities. For example, a rise in oil prices can strengthen the Canadian dollar (CAD) due to Canada’s status as a major oil producer. Conversely, a fall in commodity prices can weaken the currencies of countries that rely heavily on exports of those commodities. Additionally, some currency pairs may be more strongly correlated with certain commodities than others, and these correlations can shift over time depending on various economic and geopolitical factors. I believe that understanding the relationship between currency pairs and commodity prices can be an important aspect of forex trading strategy and a valuable insight into market psychology.

Interest Rates and Forex Markets

The relationship between interest rates and forex is an important factor to consider in forex trading. Generally, a higher interest rate in a country relative to another country tends to strengthen the currency of the former country against the latter. This is because higher interest rates typically attract more foreign capital, increasing demand for that currency, and therefore its value. Conversely, a lower interest rate in a country relative to another country tends to weaken the currency of the former country against the latter. The relationship between interest rates and forex is complex, however, and other factors such as inflation, political stability, and economic performance also play a role in determining currency values.

Economic Indicators and Forex Markets

Economic indicators are key metrics that reflect a country’s economic performance and can affect currency valuation. Some important indicators include GDP, employment data, inflation, retail sales, and consumer confidence. Positive economic data can increase the value of a country’s currency, while negative data can decrease its value. Forex traders closely monitor economic indicators to identify trends and make informed trading decisions. Correlations between economic indicators and currency valuation can be complex and can change over time, so traders need to stay up-to-date on the latest developments and adjust their strategies accordingly.

How to Use Market Correlations in Forex Trading

Building Forex Trading Strategies with Market Correlations

Building a forex trading strategy around market correlations involves identifying which currency pairs are positively or negatively correlated and then using this information to make trading decisions. Traders can use historical data and analysis to identify the strength and direction of correlations between currency pairs and other markets, such as commodities and stocks. The next step is to incorporate this information into a trading plan, which could involve using hedging strategies to mitigate risk or taking advantage of opportunities to trade in multiple markets simultaneously. It is also important to continually monitor and update the strategy as correlations can change over time.

Here are some examples:

- Hedging strategy: A hedging strategy involves taking two positions in different currency pairs that have a strong negative correlation. If one trade starts to lose money, the profit from the other trade can help to offset the losses.

- Carry trade: A carry trade strategy involves borrowing money in a currency with a low interest rate and investing it in a currency with a higher interest rate. This strategy is based on the correlation between interest rates and forex.

- Commodity currency strategy: This strategy involves trading currency pairs that are correlated with the prices of commodities, such as the Canadian dollar and the Australian dollar. Traders can use commodity prices as a leading indicator for currency movements.

- News trading: News trading involves trading currency pairs that are correlated with economic indicators, such as GDP, employment, and inflation. Traders can use these indicators to predict the direction of currency movements and take positions accordingly.

- Trend following: A trend-following strategy involves identifying currency pairs that have a strong positive correlation and trading in the direction of the trend. Traders can use technical analysis indicators such as moving averages or simple price action to identify trends and make trading decisions.

Benefits and Risks of Trading Based on Market Correlations

The main benefit of trading based on correlations is that it can provide an additional layer of fundamental analysis and confirmation for a trader’s decisions. By identifying and analyzing correlations between different currency pairs, commodities, and economic indicators, traders can gain a better understanding of the broader market trends and potentially improve their trading accuracy.

However, there are also risks associated with trading based on correlations. Correlations can shift or break down unexpectedly, especially during times of market volatility or changes in economic conditions. Additionally, relying solely on correlations can lead to overconfidence and a lack of independent analysis, which can result in poor trading decisions or broken/obsolete trading algorithms. It’s important for traders to use correlations as one tool in their analysis, rather than relying on them exclusively.

Conclusion

Understanding market correlations is important as it can provide traders with insights into potential movements of currency pairs and help them identify trading opportunities.