In the fast-paced world of forex trading, understanding market sentiment can be a powerful tool for traders looking to make informed decisions and maximize their chances of success. But what is market sentiment, and how can it be used effectively in forex trading? In this post, we’ll explore the concept of market sentiment and discuss its role in the forex market. We’ll also look at different ways to measure and analyze market sentiment, and provide tips and strategies for using market sentiment to inform your trading decisions.

Sentiment is in essence, the market’s mood. Think about your mood – it can change at any time and for many, many reasons, right? Market sentiment is similar in concept. So, if you picture the market as a single organism comprised of many smaller organisms, you will get a picture of what is essentially crowd mentality. The market is a crowd. The crowd has a mood. The mood can change at any time and for many reasons. That mood determines price direction.

And don’t encapsulate market sentiment into one single mold. It’s not only what the market is feeling about a specific risk event or news… it’s also fear and greed, risk appetite, profit taking, stop hunting… you name it. All of that is sentiment. When a currency pops or dips, that was sentiment. When you have no clue why something keeps going, it’s also sentiment. Sentiment will answer every question you have about the intraday moves you see. Why is Sterling doing this? How come the Yen crosses got so sold off? How come Euro broke the lows? Sentiment is why. Nothing else. And if you understand market sentiment analysis, you will have these answers and never again ask yourself “Wait! What just happened?”

What is Market Sentiment in Forex Trading?

As shorter-term traders, sentiment is our primary driver. So, trying to understand this crowd entity and its moods is key to using sentiment in our trading. Apart from getting you answers to why certain market movements occurred, sentiment will also give you opportunities. If you know what kind of mood the market is in, you will be able to use that as confluence for your trade ideas and confirmation for your trade plan. Combining market sentiment and technical analysis will allow you to generate some very solid trade ideas and plans.

Sentiment in FX is the mood of the market, with the market being comprised of thousands upon thousands of people. Sentiment on a specific issue can last minutes, hours, days… even weeks, depending on a multitude of factors. On top of that you may get sentiment reacting one way one week to a certain event and then reacting differently or not at all the following week to THE SAME event! It is a fickle little bugger. As complex as that may sound, it really boils down to your ability to research and understand sentiment. Once your skills are developed and you are able to understand market sentiment and news, then most of the complexities disappear – you will know why the market’s mood is reacting one way or another. You will know what is causing it and you will understand why one reaction may differ from another.

Another very valuable aspect of learning how to read sentiment is that you will be able to determine if the sentiment is warranted or if it is just fear or greed… you will be able to make decisions related to how long you believe that sentiment will last – you will recognize sentiment patterns the same way you recognize price action ones. This will come in handy when analyzing price movement and determining the strength of said moves. When looking at sentiment, the most important factor is understanding the reasons why the market is moving in a specific direction or trading in a specific way. Fundamentals and fundamental analysis will give you the reasons why the markets are moving a specific way and help establish a baseline for longer term projections… market sentiment does exactly the same thing but in the short term.

How to Use Market Sentiment Indicators in Forex Trading

Market sentiment indicators are different to what you may be thinking about when the word “indicator” comes to mind. Sure, some brokers will give you some statistics about whether retail traders are more long or short a given instrument on their platform, and call those sentiment indicators…but the reality is that they are not. Market sentiment indicators are more intangible and cannot be extrapolated from historical trade bias data. Sentiment is current, it is present and it is alive. It requires attention to economic and geo-political news as it happens, risk environments and more to get a good read of what the market is thinking and how it is reacting to what it thinks. You have to read the crowd and learn how to trade alongside it and maybe even try to anticipate what it’s going to do next (easier said than done).

The more you practice reading sentiment, the easier it will get. And take it from me… at some point you will be able to identify sentiment so quickly that it will become second nature. Hard work and practice will get you there.

The Impact of News and Economic Events on Market Sentiment in Forex Trading

News and economic events are the main drivers of market sentiment. These events will provide the markets with information which will in turn be analyzed and digested. The result will be one of two possible outcomes; the market sentiment will either change or remain the same. Simple as that. If market sentiment was bullish the USD and a news event affected the outlook for the greenback, the sentiment would either remain Dollar bullish or would change (either to neutral or bearish USD). The market will always have a market sentiment and economic events baseline (i.e.; it will have a “stance”) and that baseline will be affected by what the market thinks or believes as a result of that news event. If the news event reinforces the market’s existing beliefs, then existing sentiment gets reinforced. If it does not, it may taper or change market expectations and maybe even cause a change in price behavior and direction.

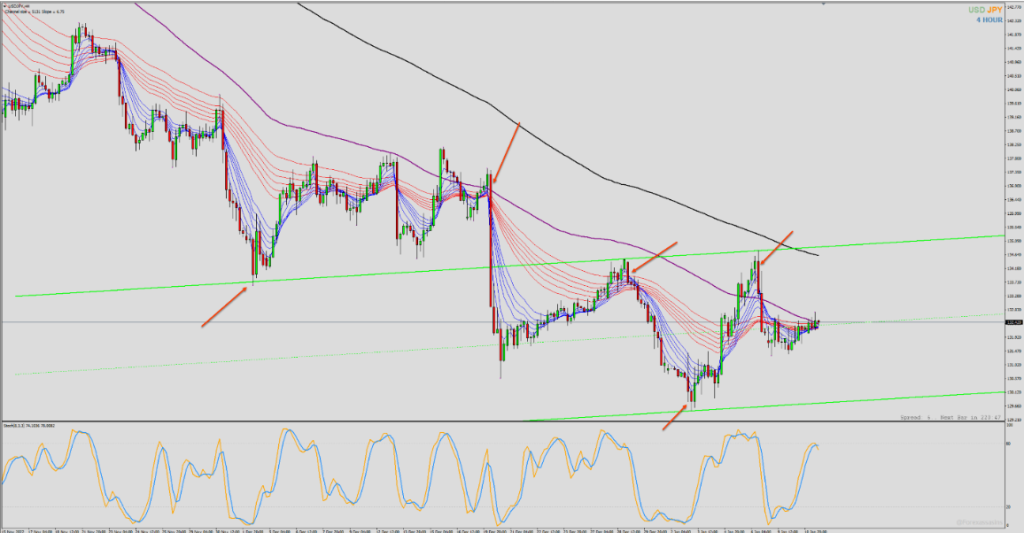

Check out this chart screenshot as a simple example. Price swings, where price changes direction violently or drastically, are usually points in time in which the outlook for the asset (in this case USDJPY) changes. These price turns are usually based on short term sentiment changes where the market switches from bearish to bullish or vice versa based on some sort of economic release, statement or other risk-based news. These sentiment “turns” often occur at technical levels.

Managing Risk with Market Sentiment in Forex Trading

Is it possible to manage risk using market sentiment? Market sentiment and trading psychology are tightly knit concepts. They both contribute to an aspect of trading that is often overlooked; risk management through sentiment analysis. Trading psychology is a topic well beyond the scope of this article so let’s just quickly focus on how sentiment reading can protect your capital. It is simple; much simpler than you imagine. Analyzing sentiment properly allows you to read and oftentimes predict market movement with a higher degree of accuracy than if you were using technical analysis alone. If you have a solid grasp on why the market is moving the way it is, you can easily integrate that knowledge into your decision-making process.

Want to take that JPY long but sentiment looks Yen bearish? Then you may hold off on that trade, trade smaller positions or scrap the idea altogether until you think a sentiment change is closer. You are in profit on a GBP long and sentiment is starting to turn Sterling bearish? Then maybe you exit and take your gains a bit ahead of time. Simple. The point is that knowing what the market is thinking, its mood, will allow you to make better decisions regarding your capital risk protection.

If you want to learn more about market sentiment, to read it like a professional and how to take advantage of it in the markets for your own trading, then check out my mentoring program at https://thefxmentor.com .